Georgia Real Estate Disclosures in 2026: What the Law Requires, What the Forms Do, and Where Confusion Creates Risk

- CCK

- Dec 16, 2025

- 6 min read

One of the most persistent misunderstandings in Georgia real estate is the belief that disclosure obligations come from forms. They do not.

Disclosure duties in Georgia come from law — primarily decades of court decisions — and the GAR forms exist to prompt, document, and memorialize compliance with those legal duties.

The 2026 forms did not change this framework. They reinforce it.

This article walks through all of the revised disclosure-related forms used in Georgia residential transactions — F301, F302, CAD, Lead-Based Paint, and 2 New GAR Disclosures — with an emphasis on what is actually required, what is optional, and how agents should use each form in practice.

The Legal Starting Point: Caveat Emptor (Buyer Beware)

Georgia remains a caveat emptor state. This doctrine:

Is created by case law, not REALTOR® forms

Places the burden of due diligence on the Buyer

Requires Sellers to disclose known latent defects

A latent defect is one that:

Is known to the Seller and

Could not be discovered by a Buyer through reasonable inspection

The obligation to disclose known latent defects exists whether or not any form is used.

F302: Seller’s Disclosure of Latent Defects —

Not Mandatory, but Critically Important

What F302 Really Is

The F302 is not legally mandatory. No statute requires a Seller to complete it.

Instead, F302 is:

A prompting tool that walks the Seller through the legal duty to disclose known latent defects

A written record of what the Seller says they know at a specific point in time

A risk-management document for Sellers and Agents

An option for Seller not willing to complete a full property disclosure, usually due to limited knowledge of the property being sold - though it can be used by any Seller

The 2026 for states:

Caveat emptor (“buyer beware”) is the law in Georgia and this Disclosure may not be modified by the Buyer.m

That language confirms the law exists independently of the GAR forms.

Why Agents Should Still Use It

While not mandatory, F302:

Encourages Sellers to think carefully about what they know

Reduces “I told you verbally” disputes

Helps Agents document that disclosure was addressed

Better option than no disclosure at all since Sellers do not usually understand the obligations of disclosure and take "as-is" to mean they do not have to tell Buyers about issues that are concealed (hidden)

In practice, the duty is mandatory — the form is not.

F301: Property Disclosure Statement —

Voluntary and Broader

What F301 Does

The F301 is a voluntary, expanded disclosure that allows Sellers to share broader condition information beyond latent defects. Many requests have been made to add things to this form over the year. All are considered by the forms committee but there must always be a balancing of giving the Buyer what they may want and making a disclosure so difficult to complete that Sellers stop wanting to fill it out at all.

It can include:

Known issues with and details of systems or components

Prior repairs or improvements

Environmental or neighborhood concerns

Unlike F302, F301 is not limited to latent defects and often covers patent (obvious) conditions as well.

Risk and Reward

Used thoughtfully, F301 can:

Set Buyer expectations early

Reduce renegotiations and disputes

Create transparency that supports smoother closings

Used carelessly, it can:

Conflict with marketing descriptions

Create ambiguity through vague answers

Create mis-disclosure when the Seller gives answer that they know or should know to be untrue.

Consistency and accuracy matters.

2026 Changes

F302 Latent Defect Disclosure added a warning that Georgia is a Buyer Beware state.

F301:

Reworded the warning to Buyers and Sellers.

Added propane and fuel tanks to the things that might be rented rather than owned.

The entire Flooding and Water Intrusion section was rewritten to cover all known ways to ask the Seller for information and historical details.

CAD: Community Association Disclosure —

Statutorily Required When Applicable

Not Legally Required — But Practically Necessary

The Community Association Disclosure (CAD) is not legally required to create a valid contract.

So why does the CAD exist?

Because in modern practice:

Buyers usually cannot access association information directly.

Management companies routinely place key details behind paywalls.

It is unreasonable to expect Buyers to pay out-of-pocket just to learn basic ownership costs.

What the CAD Accomplishes

The CAD:

Centralizes information about assessments, fees, and transfer costs

Identifies pending litigation or special assessments

Discloses costs that directly affect cash to close

Where Deals Fall Apart

The real risk is not contract validity — it’s financial feasibility.

Problems arise when:

Transfer fees, initiation fees, or capital contributions exceed a Buyer's available cash

Lender cash-to-close limits are blown

Parties argue later over who pays what

The CAD helps prevent issues and disputes by getting the numbers on the table early.

2026 Changes

The directions were reworded but still say that the Seller has to figure out the charges and disclose them before they go under contract with a Buyer or the Seller will be paying the costs.

The check boxes were corrected for the type of community with condo being one option and POAs/HOAs being a separate option.

The section for the regular association dues corrected the layout and added a section for random additional regularly paid fees that was pulled from a different section.

Special Assessments have a very real change: For special assessments than come up as Under Consideration (as defined in the CAD) or passed after the Binding Agreement Date, if the Buyer's portion of that Special Assessment exceeds ONE YEAR of Association Dues, the Buyer has the right but not the obligation to terminate the Agreement.

🌟 Remember the formatting of many of our forms, including the CAD - A is Key Terms and the corresponding B is the explanatory language. The A & B sections should be read together to understand what is being asked of the Seller or provided to the Buyer.

Lead-Based Paint Disclosure:

Federal Law, Mandatory Compliance

The Lead-Based Paint Disclosure is required under federal law if any portion of the residential property was built before 1978.

This is not a GAR rule. It is not optional.

Sellers must:

Disclose known lead-based paint or hazards

Provide any available reports

Deliver the EPA pamphlet Protect Your Family From Lead in Your Home

Buyers must be given an opportunity to inspect for lead hazards.

No substitute form or process.

No “as-is” exception.

2026 Changes

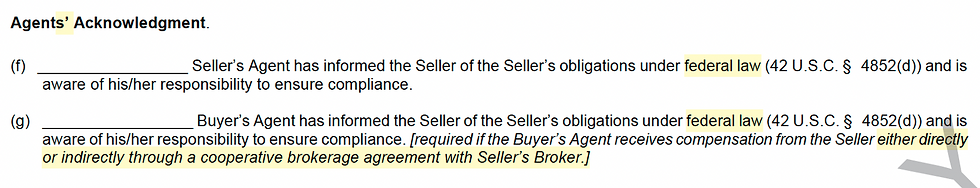

Clarified that BOTH Agents probably have obligations. It is Agent's in the federal form when it should be Agents' as it is now in our version.

Clarified that is applies whether a Seller is paying the Buyer Broker directly or cooperatively. This is found in the EPA information but only if you read their form, the footnote and the full text of the 25 pages of regulations. We have pulled all of this to the GAR form to reduce (or hopefully eliminate) the debate and argument that is currently going on between brokerages. Stop arguing. Start complying.

How These Disclosures Fit Together

Form | Required? | Purpose |

F301 | ❌ No | Voluntary, broad condition disclosure |

F302 | ❌ No | Prompts and documents latent defect disclosure |

CAD | ❌ No | Association obligations |

LBP | ✅ Yes (if applicable) | Federal environmental protection |

The biggest risk arises when agents treat optional forms as meaningless and mandatory duties as optional.

Two NEW Disclosures for 2026

They are not mandatory.

They are there is you need or want to use them.

F331 - Buyer signs a warning before entering the property.

F344 - Buyer signs acknowledging the risks of buying property they never went to. (There is also a warning already in their Buyer Brokerage Engagement Agreement)

Best Practices for Agents in 2026

Explain the Duty First, Then the Form

Sellers need to understand their legal obligation before filling anything out.

Never Decide for the Seller

Agents explain standards — Sellers decide what they know.

Err on the Side of Written Disclosure

Silence is a common allegation in post-closing disputes.

The REALsmart Bottom Line

The law creates the duty.

The forms document compliance.

The risk comes from confusing the two.

In 2026, the smartest agents are not the ones using more or fewer forms — they are the ones who understand why each form exists and how it fits into the deal.

⭐ Want the full 2026 breakdown sent straight to your inbox?

Every Tuesday I release:

A deep-dive article

Real examples from the field

Downloadable guides

A practical “This Week’s Change” summary

CE class dates

➡️ Join the REALsmart Newsletter:

Comments